Buy Now Pay Later (BNPL) services have gained immense popularity among consumers worldwide. These services allow shoppers to make purchases and pay for them in installments, often without any interest. The convenience and flexibility offered by BNPL apps have made them a preferred choice for many consumers. As a result, the demand for BNPL app development has been on the rise. In this blog post, we will discuss the development process of BNPL apps, key features to include, and the benefits of developing such an app.

How to Develop Buy Now Pay Later (BNPL) App – Development Process

Developing a BNPL app involves several key steps, including:

- Market Research: Conduct thorough market research to understand the target audience, their needs, and the competition. Identify the unique selling points of your BNPL app.

- Define Features: Based on your research, define the features and functionalities of your BNPL app. Some essential features include:

– User registration and login

– Product browsing and selection

– Payment gateway integration

– EMI calculator

– Push notifications

– Customer support chatbot

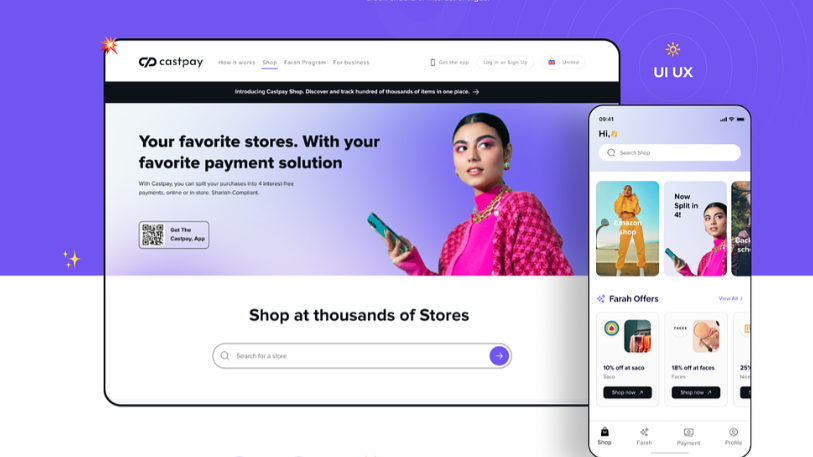

- Design UI/UX: Create a user-friendly interface that is easy to navigate and visually appealing. Focus on providing a seamless shopping and payment experience for users.

- Development: Develop the app using the latest technologies and programming languages. Ensure the app is secure, scalable, and compatible with multiple devices and platforms. You also can find a to rated mobile app development services to build your BNPL app.

- Testing: Conduct rigorous testing to identify and fix any bugs or issues. Test the app’s performance, security, and usability to ensure a smooth user experience.

- Launch: Once the app is tested and ready, launch it on app stores. Promote the app through various channels to attract users.

- Maintenance: Continuously update and maintain the app to keep it secure, up-to-date, and competitive in the market.

Must Visit: Hire app developers in india

Key Features Buy Now Pay Later (BNPL) App

To make your BNPL app stand out, consider including the following key features:

- User Profiles: Allow users to create profiles to track their purchases and payment history.

- Payment Gateway Integration: Integrate with popular payment gateways to facilitate seamless transactions.

- EMI Calculator: Provide an EMI calculator to help users estimate their monthly installments.

- Push Notifications: Send notifications to users about new offers, payment due dates, and order status updates.

- Customer Support: Offer 24/7 customer support through chatbot or live chat to assist users with any queries or issues.

- Security: Implement robust security measures to protect user data and transactions.

Benefits of Developing a Buy Now Pay Later (BNPL) App

Developing a BNPL app offers several benefits for both businesses and consumers, including:

- Increased Sales: BNPL apps can help businesses increase sales by offering flexible payment options to customers.

- Improved Customer Experience: BNPL apps provide a convenient and hassle-free shopping experience for users, leading to higher customer satisfaction and loyalty.

- Risk Mitigation: By offering BNPL services, businesses can mitigate the risk of payment defaults and fraud.

- Competitive Advantage: Developing a BNPL app can give businesses a competitive edge in the market by offering a unique and attractive payment option.

Conclusion

Developing a BNPL app can be a lucrative venture for businesses looking to tap into the growing demand for flexible payment options. By following the development process outlined above and including key features in your app, you can create a successful BNPL app by finding a best fintech app development company who can provide value to both businesses and consumers.