Trading in the CWG (Cryptocurrency, Forex, and Gold) market offers numerous advantages for investors looking to diversify their portfolios and capitalize on market opportunities. From accessibility to liquidity, this dynamic market presents unique benefits that cater to both seasoned traders and newcomers alike.

Accessibility:

Can anyone access the CWG market for trading? The CWG market boasts unparalleled accessibility, allowing individuals from Single Stock CFD diverse backgrounds and locations to participate in trading activities. Unlike traditional financial markets, which may have stringent entry requirements, the CWG market can be accessed with minimal barriers. With the proliferation of online trading platforms and mobile applications, traders can conveniently engage in CWG trading from the comfort of their homes or on the go.

Volatility:

How does volatility in the CWG market benefit traders? Volatility in the CWG market presents lucrative opportunities for traders to profit from price fluctuations. Cryptocurrencies, forex, and gold are known for their dynamic price movements, providing traders with ample chances to capitalize on short-term price swings. While volatility may pose risks, it also offers the potential for high returns, making the CWG market an attractive option for traders seeking excitement and profit potential.

Diversification:

How does trading in the CWG market aid in portfolio diversification? Diversification is key to reducing risk and optimizing returns in investment portfolios. The CWG market allows traders to diversify their holdings across different asset classes, including cryptocurrencies, fiat currencies, and precious metals like gold. By spreading their investments across diverse assets, traders can mitigate the impact of adverse market conditions on their overall portfolio performance.

24/7 Market Hours:

How does the CWG market’s round-the-clock trading benefit traders? Unlike traditional financial markets with fixed trading hours, the CWG market operates 24 hours a day, five days a week. This continuous trading environment enables traders to capitalize on market opportunities at any time, regardless of their geographic location or time zone. Whether it’s daytime or nighttime, traders can actively participate in CWG trading, maximizing their potential for profit and flexibility.

Liquidity:

How does liquidity in the CWG market impact trading activities? Liquidity is a crucial factor for traders, as it determines the ease with which assets can be bought or sold without significantly affecting their prices. The CWG market is known for its high liquidity, particularly in major currency pairs, popular cryptocurrencies, and widely traded gold contracts. This abundance of liquidity ensures that traders can enter and exit positions swiftly, facilitating seamless trading and minimizing slippage.

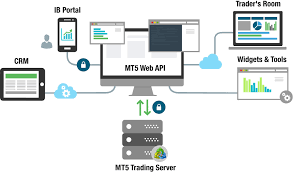

Advanced Trading Tools:

What advanced tools are available for trading in the CWG market? To cater to the diverse needs of traders, the CWG market offers a plethora of advanced trading tools and technologies. From charting software and technical indicators to algorithmic trading platforms and social trading networks, traders have access to an array of tools to enhance their trading strategies and decision-making processes. These advanced tools empower traders to analyze market trends, execute trades efficiently, and manage risk effectively in the dynamic CWG market.

Regulatory Oversight:

How does regulatory oversight ensure the integrity of the CWG market? Regulatory oversight plays a crucial role in maintaining the integrity and stability of the CWG market. While cryptocurrencies operate in a relatively decentralized and unregulated environment, forex and gold trading are subject to regulatory frameworks enforced by government authorities and financial institutions. These regulations aim to protect investors, prevent fraud, and maintain fair and orderly markets, instilling confidence among traders and fostering trust in the CWG market ecosystem.

Conclusion:

In conclusion, trading in the CWG market offers a host of advantages for investors seeking opportunities in the dynamic world of finance. From accessibility and volatility to diversification and liquidity, the CWG market caters to the diverse needs and preferences of traders, providing them with the tools and opportunities to succeed in their trading endeavors. Whether you’re a seasoned trader or a newcomer to the world of finance, the CWG market presents an exciting and lucrative arena for pursuing your investment goals.